-

blog

2018

- ERM Applied - Expanding Services

- AUTHOR: Achille Sime

Hamilton, November 4, 2018 - SL FINANCIAL an actuarial consulting and advisory firm is returning to Bermuda to play a major role during the 1/1/2019 reinsurance renewal, while expanding its service offering to catastrophe modeling.

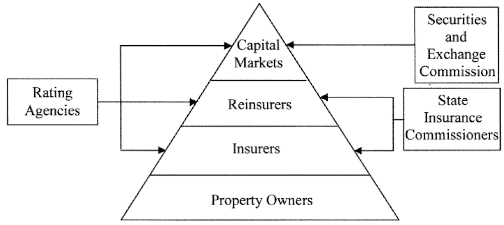

In her book “Catastrophe Modeling: A New Approach to Managing Risk”, Patricia Grossi et al presents the key stakeholders in the management of risk (see figure):

Key Stakeholders in the Management of Risk

- Property owners: bear full cost of losses from natural disasters or take steps to mitigate or transfer some of the risk

- Insurers: offer coverage to property owners against losses from natural disasters

- Reinsurers: offer coverage to insurers against the possibility of large payments from catastrophe

- Capital Markets: provide financial protection to both insurers and reinsurers through financial instruments, such as catastrophe bonds or collateralized reinsurance arrangements

- Rating agencies: provide independent evaluation of reinsurers’ and insurers’ financial stability along with their ability to meet their obligations to policyholders

- State Insurance Commissioners: provide insurance solvency and rate regulation at state level

- Securities and Exchange Commission: protect investors, maintain fair, orderly and efficient markets, and facilitate capital formation

A catastrophe models is employed to assess catastrophe risk and improve risk management decisions. The model output is quantified and presented in a way that is useful to stakeholders. Then, based on these metrics, alternate risk management strategies, such as mitigation, insurance, reinsurance and catastrophe bonds, can be assessed.

An important concern for (re)insurers is the concentration of risk (i.e. large number of properties in a single geographic area, therefore facing the possibility of large losses should a natural disaster occur in the area). Reinsurers and insurers often use diversification across several regions and risks to mitigate against concentration risk.

According to CEO Achille Sime, “Expanding our service offerings from working with all stakeholders involved in the management of risk in area of actuarial risk consulting and alternative risk financing to also include catastrophe risk modeling, constitute an application of diversification mitigating strategy applied to running a Small Business Enterprise (SBE).”

MEDIA CONTACT

Achille Sime

CEO

asime@sl-financial.com

2525 Ponce De Leon Blvd, Suite 300

Coral Gables, FL 33146

- Achille Sime

Principal/CEO

Fellow of the Institut des Actuaires France (FIAF)

Fellow of the Society of Actuaries (FSA)

Member of the American Academy of Actuaries (MAAA)

Chartered Enterprise Risk Analyst (CERA)

Affiliate of the Casualty Actuarial Society (AFFI CAS)

- bio