-

blog

2019

- Feedback from 46th AIO South Africa

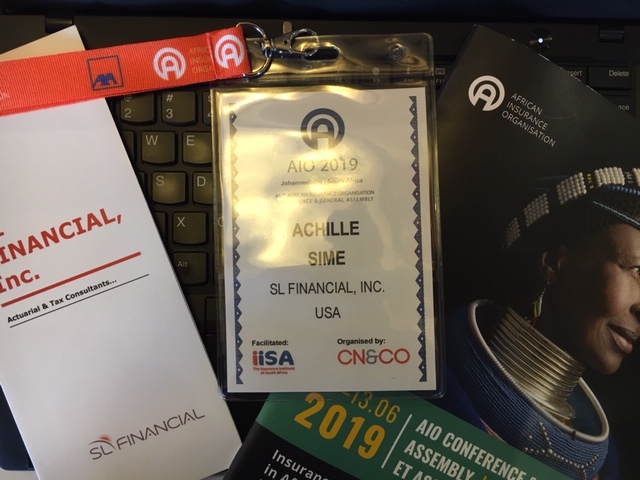

- AUTHOR: Achille Sime

Johannesburg (South Africa), June 12, 2019 – SL FINANCIAL is an actuarial consulting and advisory firm based in Miami, Florida. We offer complete actuarial solutions in both traditional (re)insurance and alternative risk financing industries.

The 2019 African Insurance Organization Conference was held in Johannesburg South Africa from January 10-12, 2019. As an actuarial consulting firm with ties to the region, SL FINANCIAL attended the conference and can provide the following feedback:

- African Economic Landscape Readiness – Is the landscape ready for insurance penetration and what can the continent learn from South Africa?

o Demographic statistics and economic indicators suggest Africa is at the right position to play a leading role in the world economy over the next century

o African insurers have a significant role to play and can do so by learning from each other and working together

o One key challenge for the insurance industry in Africa is the need for talents and reliable data of superior quality

- Insurance Role in Poverty Alleviation – Insurers have a KEY role to play:

o Focus on customer promises is no longer optional but rather required

o From a risk management prospective, this new focus should be reflected in the data by increased claim ratio coupled with reduced frictional costs

- Surviving Floods & Drought – Africa is not immune from the effects of climate change:

o There may be increases in some types of claims (e.g. flood, drought, wind), but also opportunities in green insurance products and insurance investment

o Insurers can play a KEY role through innovative products (e.g. parametric insurance) and financing mechanisms (e.g. capital market reinsurance)

o Solving the protection gap equation involves increasing affordability (i.e. reducing cost) and/or increase capacity

o The above solutions are only possible with reliable data of superior quality

- Role and Impact of Regulation in Driving Inclusivity – Regulation have a KEY role to play:

o African regulators have engaged with the market in effort to increase inclusivity

o Results are still mitigated, and solution might come from improved coordination between regulatory bodies

o Some governments have implemented financial inclusion policies, but financial literacy and lack of suitable distribution channels still constitute an issue

o Finally, the global movement towards risk-based solvency regimes adds to the complexity regulators' tasks

Overall, SL FINANCIAL managed to increase its market presence in Africa by joining the AIO, with ambition to contribute to the insurance penetration of insurance or innovative risk financing in the region. Finally, we have presented our NEW Data Repository & Analytics (DRA) platform to selected market participants and have received valuable feedback prior to official public release in the upcoming months.

MEDIA CONTACT

Achille Sime

CEO

2525 Ponce De Leon Blvd, Suite 300

Coral Gables, FL 33146

- Achille Sime

Principal/CEO

Fellow of the Institut des Actuaires France (FIAF)

Fellow of the Society of Actuaries (FSA)

Member of the American Academy of Actuaries (MAAA)

Chartered Enterprise Risk Analyst (CERA)

Affiliate of the Casualty Actuarial Society (AFFI CAS)

- bio